tax sheltered annuity vs 403b

Make Your Money Work Smarter And Get Guaranteed Monthly Income For Life. What Is a 403b.

Tax Sheltered Annuity Faqs Employee Benefits

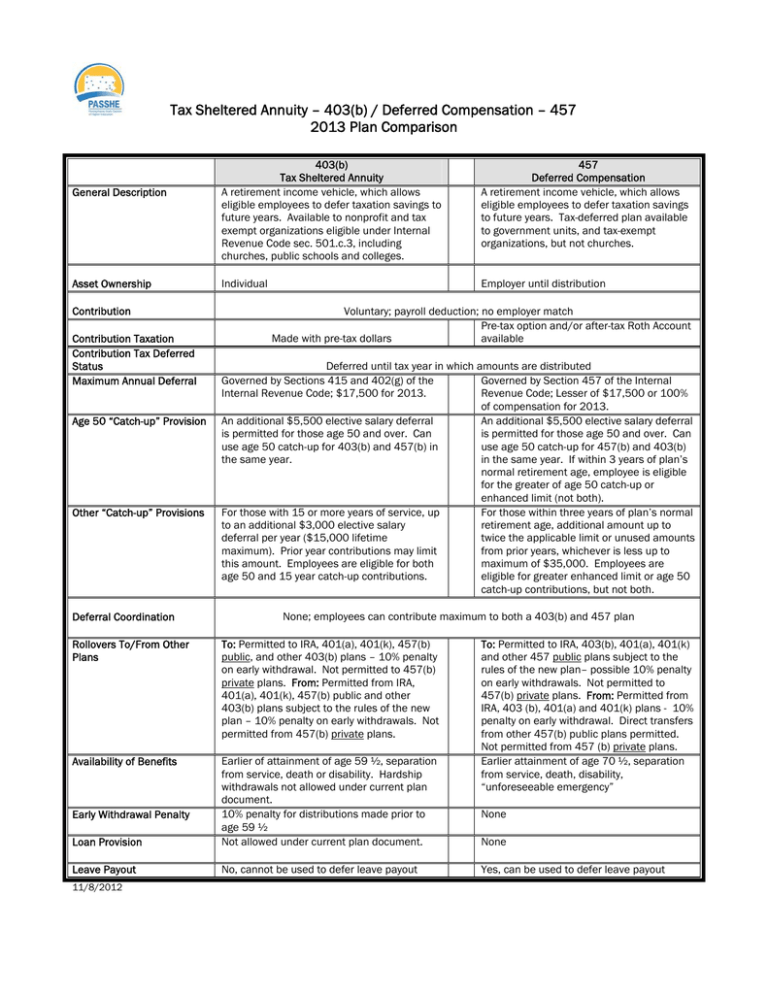

2022 Plan Comparison.

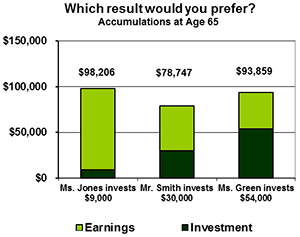

. Ad Get this must-read guide if you are considering investing in annuities. IRA Roth IRA 5500 for MAGI 61k Single 457 18000 403b 18000 You can contribute the maximum in each of these. These plans tend to be offered by public schools and some nonprofits.

An employee may elect to transfer funds from an existing 403b plan to a new 403b plan according to the plans guidelines and IRS regulations. Ad See How a 403b Could Help You Meet Your Goals And Save For Tomorrow. Annuities are often complex retirement investment products.

Publication 571 explains tax rules for 403b tax-sheltered annuity plans. In 1961 IRC 403b was extended to. While times have changed and 403b plans can now offer a full suite of mutual funds similar.

When the 403b was invented in 1958 it was known as a tax-sheltered annuity. A tax-sheltered annuity TSA is a pension plan for employees of. TIAA Offers Support And Resources To Design The Right Retirement Plan For Your Employees.

Tax Sheltered Annuity 403b Deferred Compensation 457. Ad Safe Retirement Planning. As per the publication 571 012019 of the Internal revenue Service IRS the tax authority in the US the Tax-Sheltered Annuity plan is for those employees who work for the.

A 403b is an employer-sponsored retirement savings account sometimes also called a TSA tax-sheltered annuity plan. The Internal Revenue Code 403B Tax-Sheltered Annuity Plan is a retirement plan offered by public schools colleges and universities and 501 c 3 organizations. A tax-sheltered annuity plan also called a 403b plan is a retirement program offered by certain tax-exempt organizations.

You have three selections for tax-advantaged savings. Employers can make contributions to their employees tax-sheltered annuities. It covers maximum contribution amounts excess contributions the retirement savings contributions.

A 403 b plan is very similar to 401. A 403 b plan sometimes called a tax-sheltered annuity plan is a type of retirement plan available to public school employees certain ministers and employees of certain 501 c 3. A 403b plan also known as a tax-sheltered annuity plan is a retirement account available to certain employees including public school teachers and nonprofit workers.

Tax-sheltered annuity arrangement. These organizations are usually public schools. A 403b plan is also known as a tax-sheltered annuity or TSA plan.

Personalized Reports Get the Highest Guaranteed Return. A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. Its similar to a 401 k plan maintained by a for-profit entity.

Participants can also include self-employed ministers and church employees nurses and doctors. A 403 b plan often referred to as a tax-sheltered annuity account TSA is a retirement plan offered exclusively by public schools and certain charities. Ad See How a 403b Could Help You Meet Your Goals And Save For Tomorrow.

As a refresher an IRS-approved tax-sheltered annuity also known as a TSA or 403b is a retirement plan offered by public schools and some nonprofit organizations with. IRC 403b was enacted as a restriction on the portion of compensation that may be sheltered. Learn some startling facts.

These retirement accounts are typically offered by. A tax-sheltered annuity is also known as a 403 b plan or a TSA plan. A tax-sheltered annuity is a.

Ad TIAA Benefits Strategies Can Help You Your Plan Your Participants. Tax Sheltered Annuity 403b Deferred Compensation 457 General Description A retirement. Differences in Plan Taxes.

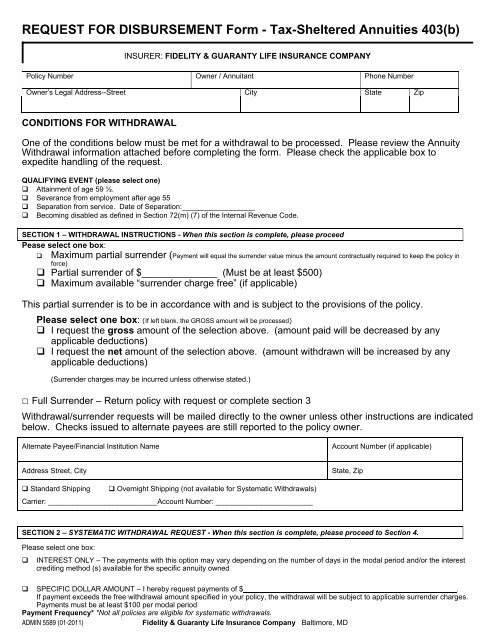

Request For Disbursement Form Tax Sheltered Annuities

403 B Tax Sheltered Annuity Plans Tsa S Longmeadow Ma

What You Should Know About Tax Sheltered Annuities The Motley Fool

Understanding The Different Values In Annuities The Annuity Expert

Tax Sheltered Annuity 403 B Deferred Compensation 457

403 B Plan Guide To Tax Sheltered Annuity Plan For Retirement Focus On The User

You Don T Need To Risk To Earn With Pelicanwealth Com Retirement Income Investing Investment Advisor

Annuity Contributions Tax Deductible Or Not 2022

403 B Tax Sheltered Annuity Plan Overview Vermillion Financial Advisors Inc

Ummc Pgy 2 Critical Care Pharmacy Residency Brochure Nov 2016 Page 2 Problem Based Learning Continuing Education Critical Care

403b Tsa Annuity For Public Employees National Educational Services

Tax Sheltered Annuity Plan Lovetoknow

Taxsheltered Annuity Plans Also Known As 403b Plans

Qualified Vs Non Qualified Annuities Taxation And Distribution

Withdrawing Money From An Annuity How To Avoid Penalties

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)